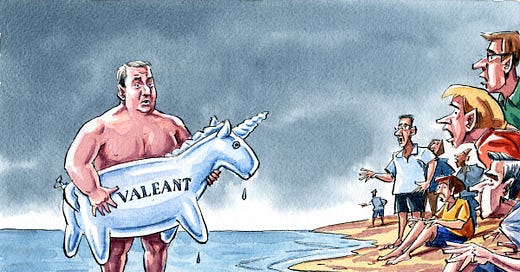

In my last B&B post, on deteriorating conditions in the IPO market, I concluded with this statement from Warren Buffett “It is only when the tide goes out that we see who has been swimming naked”. And this seems to be what we have to look forward to in the coming months, as the capital markets turn increasingly bearish. Be warned, the results will not be pretty. Let’s face it, most of us do not look so great without our clothes on.

This is true of many companies as well. When the tailwinds stop blowing, whether in the form of benign economic conditions or low interest rates or bullish financial markets or excessive optimism or too much money chasing too few deals, investors belatedly refocus on corporate fundamentals and reported financial results, removing lipstick from the pig as it were.

And so I am paying close attention to the unwinding of all those overhyped companies that raised large amounts of money from gullible investors at silly valuations, as well as some solid companies whose share prices simply got out of whack with reality over the past few years, in some cases due to real but temporary boosts to their businesses during covid.

Here, without further commentary, are some of the sectors, themes and stocks that I am following, with the expectation that the falling financial tide will leave many vulnerable companies stranded naked on the beach:

— Crypto (Bitcoin, Coinbase, TerraUSD)

— The covid economy (Peloton, Netflix)

— Big tech (QQQ)

— Investor hubris (Softbank VisionFund)

— EVs (Tesla, Rivian)

— The cult of personality (Elon Musk and Twitter)

— Meme stocks and options (GME, AMC, Robinhood)

— Junk bonds and leveraged loans

Expect more commentary in subsequent posts. In the meantime, see the links below, and check your investment portfolios!

Links:

Changing Investor Behavior, WSJ 5.11.22

Coinbase Keeps Sliding after Earnings Report, WSJ 5.10.22

TerraUSD Plunges as Investors Bail, WSJ 5.11.22

Netflix Faces Reality Check, WSJ 4.21.22

Peloton’s Problems Continue, WSJ 5.10.22

Softbank VisionFund Lags after Five Years of Big Investments, WSJ 5.10.22

Ford Sells Stake in Rivian, WSJ 5.9.22

Charlie Munger Takes Another Swipe at Robinhood, WJS 5.1.22

How US Covid Stimmies Helped Fuel Meme Stocks, WSJ 3.4.22