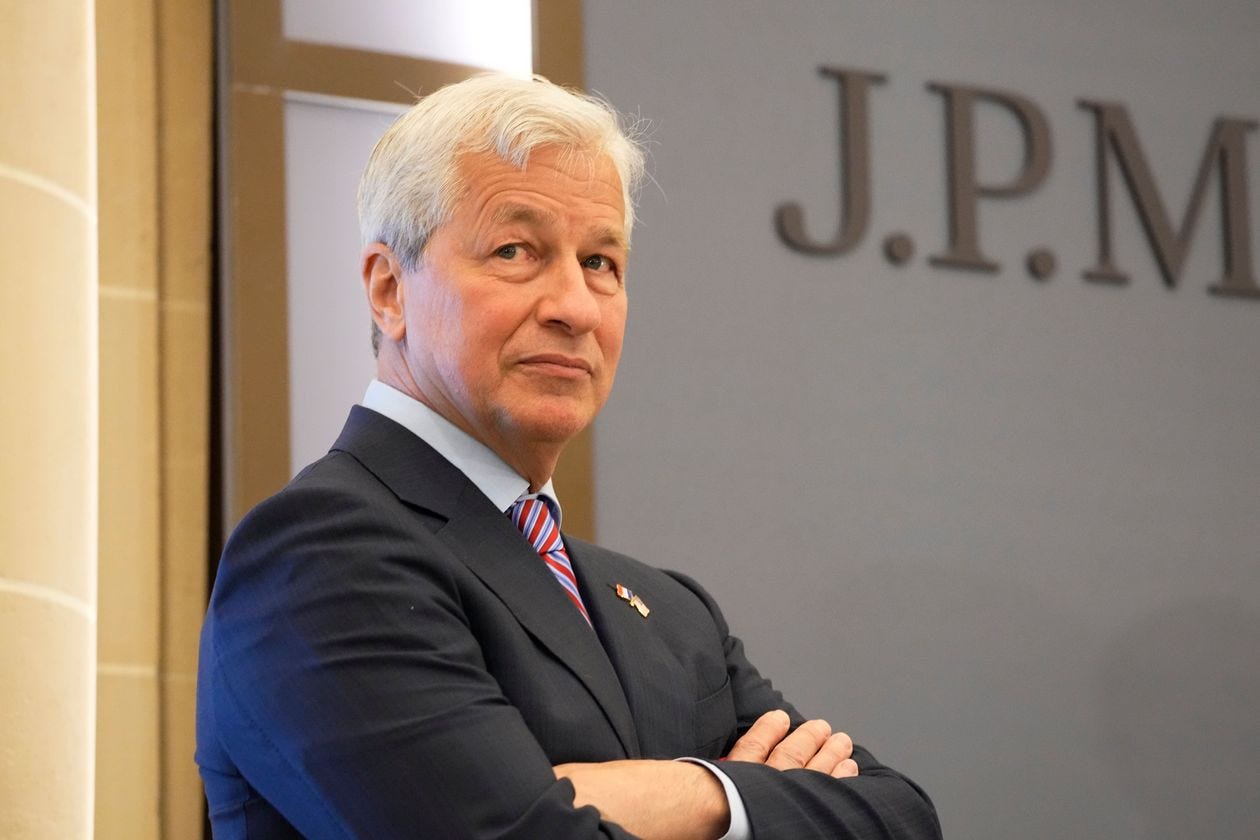

The US economy is booming and so are the banks. JP Morgan CEO Jamie Dimon says the US consumer is raring to go. And banks like JPM are reporting strong second quarter results. Loan growth and net interest income remain stagnant, and trading revenues were down against a very strong year-ago quarter, but business is generally strong across all segments of JPM’s business: Consumer & Community Banking; Corporate and Investment Banking; Commercial Banking; and Asset Management & Private Banking. Investment banking fees were up 25% to an all-time high, driven by strong M&A volumes, and JPM topped the global fee league tables with a market share of almost 10%. JPM is releasing billions of dollars of unneeded reserves, capital and liquidity are strong, and the bank is again returning billions of dollars to shareholders in the form of dividends and buybacks. JPM’s share price is up 25% YTD and 60% in the past year. As a JPM shareholder, I am delighted.

Here is what Dimon had to say about the US consumer: “Their house value is up. Their stock value is up. Their incomes are up. Their savings are up. Their confidence is up. The pandemic is kind of in the rearview mirror, hopefully. They are raring to go.”

This is not entirely a US phenomenon, although the US economy is doing particularly well. Things are also improving across the Atlantic, albeit at a slower pace. UK and European banking regulators are again allowing banks to return capital to shareholders, as US regulators did earlier this year, a clear sign that they believe the worst of the Covid crisis is now behind us.

Overall banks have survived the Covid crisis nicely. But let’s not forget that Covid is not quite done with us, even if we would all like to be done with it. And I think we should all acknowledge that the strong performance of banks during the Covid crisis is attributable in large part to the unprecedented level of central bank liquidity and fiscal stimulus provided by governments across the world. Neither the real economy nor the banks would be in nearly as good a shape as they are today without this truly extraordinary government support. Back in 2008 it was the banks that got bailed out; this time it was their customers. But in both cases the economy and the banking system survived only with the help of unprecedented levels of governmental assistance. And we have yet to see what will happen when this government support begins to be withdrawn.

So yes banking is booming and all engines are firing. For now.

To learn more, read here:

Jamie Dimon says US Consumer is Raring to Go, WSJ 7.13.2021

JPM Earnings Release, 7.13.2021